When 401ks began, they all looked good and were performing well in the late 90s and people were impressed as investments were growing. In 2000 the market collapsed and all the earnings were gone. 401k money was going into company stock. Savings were lost and so were jobs. Stock algorithms moved the money based on markets. Later when the real estate crashed, jolt number two with after having lost 401k money, now the house was not worth much. Consumers are now borrowing against their 401k accounts while Wall Street still gave out huge bonuses.

Attack of the Killer Algorithms – “Algo Duping 101”

I am also a privacy advocate and have a campaign going to get a law passed to license all data sellers so we know who they are and you’ll understand why that’s needed when you viisit the campaign page.  You credit card data is being sold to health insurers and more.

You credit card data is being sold to health insurers and more.

Please help!

Just click on the image or go here to donate whatever can or want as everything is appreciated. I do this to help people learn and not get hosed with technologies as it’s happening in one form or another, so be a skeptic when you need to be. Scroll on down and get with the Killer videos and links below and I sure you find the time worthwhile to see what code running hog ass wild is doing today.

Thank you for stopping by…

The Attack of the Killer Algorithms…

Be patient and wait as this page takes a while to laod with all the videos embedded.

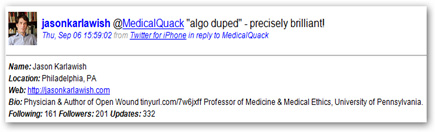

Here’s a selection of videos that offer a lot of information, which I call “Algo Duping”. I have written several posts on the Medical Quack about this topic and here’s a group of MUST SEE videos if you want to understand what is happening in the world. The general public does not like math, is afraid of it, etc. but banks and corporations are not and they use it against us. First off let’s hear from Charlie Siefe, Who Wrote the Book, “Proofiness, The Dark Arts of Mathematical Deception.

Yes it is alive and well so hear what he has to say as it’s true. After this video there’s a couple links to PLOS One studies, the first one says “the fear of math causes physical pain” with humans, and it’s an all out study with MRI images and all. Why do you think Wall Street and big corporations win all the time, they don’t have this fear or got over it, they do math and right in the beginning of the video, Charlie says just that, people hate math and thus they are open to be Algo Duped as they don’t know the difference and a lot of it is hard to tell. Hmmm, formula has a square root in it, been all over the news, well it must be right, wrong. The second one is a little more tech minded and talks about methodologies to fiddle with a P Value and Charlie explains what that is in the video for finding value. Check the links at the bottom of this video.

Context is Everything–More About the Dark Arts of Mathematical Deception–Professor Siefe Lecture Given at Google’s New York Office–Big Healthcare Focus

“Algo Duping” – PLOS One Journal Publication Explains Why The Fear of Math Plays a Big Role As One Underlying Reason We All Get Duped And Those Who Don’t Fear Math Take All the Money, Gradually, Using “Mathematical Formulas & Algorithms” PLOS One Abstract–Methodology for Detecting Manipulation of “P Values” To Show Significant Statistical Value, “Inappropriate Fiddling” Which Can Lead to “Algo Duping” Situations And Numbers

So why am I here to learn about math? Are you telling me I need to become a mathematician? Not at all but to rather become aware of how math and algorithms and computer code impact you everywhere you go. This is a video from Edward Frenkel, mathematician from Berkeley University that is just a short discussion on why people hate math. He’s telling us that there’s a need to understand what goes on in the financial world today and to be aware of the basics of how it works. He states it’s essential to our freedom and to appreciate the power of those that do both bad and good. He wants everyone to be in on the “secret”. You may not share the same depth of the love of math that he does but again he spells out the essentials of just basically knowing the impact of math in the world, which is what this page of videos is all about.

This video is for everyone and goes back through how math evolved. You will see how math appears in the world today. It’s not a perfect science as most think. Toward the end of the video pay attention to the comments made, especially those by software engineers. There are limitations and engineers have a real good hold on the elegance of math as it meets the messiness of reality. Engineers live in the domain of the approximate, they admit terms in equations and create models to meet our needs. Math shortcuts that simplify equations is the key and for engineers, “close enough” is good, they get paid to do things “just good enough”. Engineers sacrifice the precision of mathematics to make it useful, very good video overall that asks a few interesting questions. In the end it remains the great “math mystery, keep that thought when you think about both financial and healthcare models and their math.

The next video will focus on how Algorithms Shape our Lives, from Kevin Slavin and again he’s right on the money here and he tells you to look for things in every day life, same thing I say about the “Attack of the Killer Algorithms” series I wrote…and you will find some of these same video over there as well. He does a very good job explaining how machines talk to machines and algorithms talk to algorithms. No human makes the calls, all done by the algos.

Now let’s really dig in and hear from some Quants, who tell exactly what they do when designing business models. This is a documentary called “Quants, the Alchemists of Wall Street” and they make the math and formulas that move money. Banks and companies use these all the time and the one interview tells you that yes they are smart and talks about their attitudes as they literally have the CEOs by the balls, as they don’t understand their own business models that they pay royally for the Quants to write. In this video you see the software designer who created the software for the big mortgage scam. It’s not his fault but rather how it was used and abused. He makes one very good quote at the end, “You Can Do Anything With Software” and also points out the software models and the real world do clash. Secondly you see folks like Emanuel Derman who got started being a quant before there was name for it and had no idea how it would evolve and watch Paul Wilmott who also started early teach Quant School.

Quants: The Alchemists of Wall Street Video Documentary – Why It Needs to Matter What Companies Do and Not Focus Only On the Price of Stock With So Called Value – Attack of the Killer Algorithms Chapter 44

Algorithms Are Stifling the World and Removing Our Freedoms, All Except the Wealthy and Why – Good Discussion on Data Selling

Algorithms are set to cause financial collapse whether you want to beleive it or not. Jaron is a world renown Computer Scientist who speaks at technology companies all over the world. He’s known well at Microsoft and other firms and has taken his knowleddge here, which is ironically the same things I speak of and I’m not a computer scientist but rather a lowly former sofware programmer. Listen to what he has to say as it’s true and I don’t know when our government is going finally take things seriously on the power of code but I sure hope it is soon. He approaches all different types of topics. If you like more you can also visit his website. You give away your data and you get some kind of service. Society will be unsustainable by the time the data harvesting even goes further. He wrote a book, “Who Owns the Future” and really has a lot of respect for the older crown in Silicon Valley as the younger folks are just lost. He discussed virtual reality in an intersting way as again he’s not against it but notes all the crazy stuff going on. Watch this video from Larry Ellison as he nails it perfectly when he says be careful with bits of intelligent software that’s smarter than you. The problem today, my very popular blog post is that people confused virtual world values with the real world.

It’s hard for people to understand…last comment great relative to big data …you believe that there’s some algorithm tht will give you wealth ..finance get into this big time, and they think their numbers will go on forever…he’s stays they are stupid essentially. There’s no supernatural creature (algorithm) that will make all this happen and last forever.

Algorithms That Exploit, Sean Gourley CEO of Quid, Physicist Extraordinaire Describes and Talks About How the World Is Being Ruled by Algorithms, Who’s Algos Are They, Am I Going To Benefit From Them, And Where Are The Good Algos?

Sean Gourley who is a physicist and owns a virtual reality company is concerned. He states we need algorithms to organize, which is true, but who’s algorithms are they and will I benefit is the question here. 61% of the internet is bots, the rest is us, the techno serf humans.

Here’s an older Dr. Gourley video, packed full of good information here too with a big focus on markets and the algorithms that live there.

60 minutes Blasts The Data Sellers, FTC Admits They Have Lost Control – Time To License and Excise Tax “ALL” Data Sellers, Banks, Companies, Etc. – Congress Needs to Act On This…

60 Minutes did a great investigative report that gives you many more additional examples on how you are being sold, your information that is and it’s flawed a lot of the time. Listen to the stories and how when it comes to fixing corporate USA errors, we are always on our own ticket to do so, is that fair? Look at the money it takes and its all about the flawed data created by the algorithms and then the end results and analytics created are faulty as well, it is a circle that doesn’t stop.

Modeling for Inequality With Segmentation, Insurance Industry Uses Backwards Segmentation As Some Models Stand to Threaten Overall Democracy

This is Cathy O’Neil who worked for DE Shaw, a hedge fund and she tells her history. She worked as a quant and taught math and she has a lot to say. Actually I’m glad she’s speaking out as she’s better than me as she has first hand experience in what it’s like to work in the financial district. She was hired to do futures with risk assessment and then nobody was using it and taking more than the suggested risk. Today she’s also part of the Occupy Movement (yes it is not dead) with their alternative banking solutions and working with credit unions. It’s a very good interview done with PBS. She’ll tell you flat out how they look at the rest of the world. She does a series of lectures called “Weapons of Math Destruction” and now writing a book with the same title . The full 4 part PBS series on Wall Street can be seen here, or keep scrolling as the entire series is here at the bottom.so get comfortable as it is long watch for all 4 parts but done very well.

Cathy O’Neill was also instrumental in the creation of the next PBS video, “The Retirement Crisis” and here we go again with Killer Algorithms that work behind the scenes with automated fees, some hidden and some not, but they are there. At the end the journalists decides to go look at his own 401k. At Cathy said in the prior video Hedge Funds are there to skim off retirement plans, one sentence.

The Retirement Game– 401k Complexities Just Like Health Insurance Have Consumers Screaming for New Models With Transparent and Accurate Mathematical Realities– More Attacks Of The “Killer Algorithms”

Now moving on…..

This is what I said at the link below when the Occupy Movement started…they didn’t know what was wrong but knew enough that something wasn’t working.

PBS also did a great story called “The Untouchables”…and again we come back to the digital illiteracy of the government. I don’t know about you, but other technologists along with myself could pick it right off that he had no clue on how to go about investigating the banks…did not even understand how “math modeling” works and this is what enabled the banks to do their “sub prime crime”…models can lie and hide risk and you can watch his body language as well as listening to him. When I watched it for the first time, it took me less than 5 minutes to make that connection, he has no clue. This has been further evidenced with the “Goldman Stolen Code” and a couple other stories…they have no clue on what code has value and what does not.

If they would have had had some decent computer scientists on the case I could almost guarantee you they would find the fraud one way or another be it the sale of the securities, flawed data on the transmission or sale or a number of other areas. Now when you find that kind of evidence, you are getting closer to black and white here. Sadly this just goes to show that relying on a couple wiretaps and little of much else just won’t make a case for you.

The State of New York still brought another case against Sergey Aleynikov after a judge threw out the first case. A jury of common consumers cannot understand all of this, I don’t care what anyone says. It is funny when you read the article about the FBI agent not knowing what “subversion” (SVC) was. Anyone in programming will laugh their fannies off at reading about it as it’s a technology used by developers to share and check code in and out…been around for years and how operating systems get built, like Microsoft and Apple use “subversion”…see what I mean about digital literacy and the important role it should play with investigating “high tech” crimes…Goldman maybe should be looking to hire old Sergey back…he’s a software engineer that did quite a bit to help the Goldman data performance metrics…

Christopher Steiner is the author of “Automate This” has this great video that talks about how algorithms are taking over the world. He begins focusing on the market and continues on to tell you how they are taking over everything. When you are asked if the call can be recorded when talking to a customer service department, no it is not just being recorded as thousands of algorithms are listening to analyze just about everything you say and a profile is built on you with data. Listen to what he has to say here and realize that activities as such lead to a lot of data to sell. As he says who’s going to be the power that runs the algorithms that take and give as Wall Street has a hard time between drawing the line between utility and menace when it comes to formulas and math, in other words they have abused over and over a society that can be controlled with math and the execution of algorithms. Software is nothing but a group of algorithms working together in the words of Bill Gates.

Here are some additional links listed below from the Medical Quack regarding “Algo Duping” and for the Attack of the Killer Algorithms to be effective, we all have to be Algo Duped, so are you or are you not…something to think about…

Data selling with banks and companies has become an epidemic in the US and they are getting rich selling data and data profiles on all of us. It’s an idea of mine to license and tax the data sellers to move some money back over to the 99% side. When the data is flawed and you are deprived of a loan, credit, etc. who’s dime are you on, yours. Many of the consumer apps and devices today also sell your data and the privacy policies are about as clear as mud. Time to license and tax the data sellers just as we license stock brokers, doctors, real estate sale people and so on. The only difference here is this is an intangible you can’t see and it’s basically the wild west with nobody minding the show. A license would open up a line of regulation as well as requiring a federal site to where all disclose what kind of data they sell and to who.

In summary the real problem here that contributes to keep some of this going is the billions made selling data. This is part of why we don’t have more jobs as companies, banks, social networks etc. don’t choose to expand but rather sell data as nobody watches, few are aware of the mechanics and so it goes on servers 24/7 and it moves money to the wealthy and keeps inequality going, sadly. Read the posts to find out a little more…how some analytics are for profit only and data is being matched and analyzed that doesn’t belong and consumers get hurt over and over. ![]()

Scientific Research–Fraud and Misconduct Rise As Competition for Funding Increases–Non Appropriate Use of Formulas and Algorithms Make It Possible To Deceive – Enhanced Scientific “Algo Duping” Big Data/Analytics If Used Out of Context and Without True Values Stand To Be A Huge Discriminatory Practice Against Consumers–More Honest Data Scientists Needed to Formulate Accuracy/Value To Keep Algo Duping For Profit Out of the Game

As Charlie Siefe says in the first video, all of this is for media attention so be aware of what is out there and see if you can tell the difference and I’m not attacking journalists per se as they have jobs and their ratings and employment security depends on how many readers they can attract too so not their fault but the way their job models are created. It’s all about context and much of the flawed data out there today is used out of context.

Let’s look at one of the biggest Algo Dupes in history and that has to be no other than Allan Greenspan. PBS did a very good documentary on this and shows who his partners were and the former banker of course has to be a Duper one would think as being from Goldman he knew what mathematics and models were created on the other side. You know what, same problem today and you rid the way for a while but eventually bad math and models will shake themselves out and it’s not pretty.

Greenspan was just an economist and could easily be duped by those who worked with models and he listened to them and convinced everyone else they were right but as we saw, it will all fall down one day, laws of math if you cheat. So again, Greenspan is the ultimate Dupe out there that with his digital illiteracy almost took down and entire country’s economy and look how long he hung on too..shameful and why we don’t need a repeat of this running the Fed. Better get someone with a “little” math in their background or watch out..history will repeat itself if we are bliss and sadly that’s about what’s out there today too. See how it worked duping Clinton as well as during good times the bad math can hide but when money runs short, you can’t hide it.

Here’s an essay worth reading for sure. I featured it on the Medical Quack and it has been published at O’Reilly as a free eBook. All you need to do is register to download the pdf…this is once again Cathy O”Neill who worked on Wall Street and saw how models worked, how some lie, how some are inaccurate and so on…

Also models and math come into play with Tax Havens…it’s all modeled by big corporations that don’t pay a lot of tax due to such havens. You can hear in this video about the Big 4 Accounting firms that set them up…this is done by the same production company that did the Quants of Wall Street above..keep in mind this is all modeled…math…

“The Tax Free Tour” Documentary on How the Tax Havens Work, Who Runs and Owns Them, How Accountants Are Taking Over the Regulators And Not Held Accountable…

How do the big 4 accounting agencies set all this up and control the regulators in this video.

“Inside Job”….

Also, if you have never seen “Inside Job” watch it. There’s a lot more history here on what lead up to the crash of the financial markets. Charles Ferguson did a great job and Matt Damon is the Narrator. Again it all comes back around to math models used for profit and nobody is asking for any transparency here with models that lie and/or hide risk and the subsequent algorithms that execute.

Money & Speed: Inside the Black Box is based on actual events that takes you to the heart of our automated world. Based on interviews with those directly involved and data visualizations up to the millisecond, it reconstructs the flash crash of May 6th 2010: the fastest and deepest U.S. stock market plunge ever. See and hear the experts, Paul Wilmott, Quant Extraordinaire and Erick Hunsader from Nanex as they watch and monitor the stock exchanges and catch rogue algorithms right and left and explains how arbitrage works, free money from the code that runs on stock exchanges.

The Wall Street Code… Haim Bodek, aka The Algo Arms Dealer

Here’s another video below that was recently released and it has to do with code, high frequency code…the subject in the documentary is a former Goldman Sachs trader who opened his own high frequency firm and just could not figure out what he was doing wrong. We are talking about a very intelligent person here who could not figure out why his algorithms were not working on the exchanges…he states he finally had some conversations and basically was told by insiders that no matter what you do and create with your code, there’s code on the exchanges with some smarter algorithms affecting access. This documentary was done by the same folks that did the Quants of Wall Street above. If you know a little bit about computer coding and algorithms, you’ll get this one for sure. If not I think even though it is a pretty high level discussion, there’s plenty for the layman to watch as well…interesting look at a current day “geek” hedge fund too..it’s all in the code and games are fixed. “I don’t think anyone really knows what’s going on”….

The Stock Market is Rigged…60 Minutes

This is another great video that talks to Michael Lewis, the author of a new book coming out that talks about the speed of the High Frequency Traders. If only we could have some of the money spent here in healthcare, but keep in mind when they talk about why the process is complex, that goes over in Healthcare any more as well. This computer-based high-speed trading uses complex algorithms to move in and out of positions in fractions of a second. These HFTs give the big guys an edge.

When you have time here’s PBS documentary in four videos that take you back in time up to almost present day, October of 2012 of how Wall Street evolved. It’s interesting to see how derivatives were born, at hotel J P Morgan meeting with a bunch of young executives and their formulas. It was the birth of a whole new way to gamble on Wall Street. Come back when you have time and watch off them though, a good learning experience. You will see Cathy O’Neil here who is in one of the above videos with her full interview here as well.

Money, Power and Wall Street….

Part One

As Wall Street innovated, its revenues skyrocketed, and financial institutions of all stripes tied their fortunes to one another. FRONTLINE probes deeply into the story of the big banks — how they developed, how they profited, and how the model that produced unfathomable wealth planted the seeds of financial destruction.

Part Two

Beginning with the government bailout of the collapsing investment bank Bear Stearns in the spring of 2008, FRONTLINE examines how the country’s leaders — Treasury Secretary Henry Paulson, Federal Reserve Chairman Ben Bernanke and New York Federal Reserve President Timothy Geithner — struggled to respond to a financial crisis that caught them by surprise.

Part Three

FRONTLINE goes inside the Obama White House, telling the story of how a newly elected president with a mandate for change inherited a financial crisis that would challenge his administration and define his first term. From almost the very beginning, there was a division inside the economic team over how tough the White House should be on the banks that were at the heart of the crisis.

Part Four

FRONTLINE probes a Wall Street culture that remains focused on risky trades. Bankers left an ugly trail of deals extending from small U.S. cities to big European capitals. For more than three years, regulators have tried to fix an industry steeped in conflicts of interest, excessive risk taking, and incentives to cheat. New regulations are being written, but can they fend off the next crisis?

Keep checking back here and there as I find new videos that are on topic, I’ll keep adding them.

The Gold Conspiracy-Secret World of Gold

This is interesting to watch here about the speculation of gold. Does the US Fed hide and control all the gold? When you watch this it brings up some very interesting questions about other nations and the US Fed. We really don’t know how much gold we have in the 4 locations where it is said we have gold.

Gold Rigging, Math And Algorithms

The Medical Quack Tip Jar…

Any contributions are always appreciated! If you found something here worth some value feel free to jump in as the Medical Quack sincerely appreciates it. I’m trying to group together enough videos that will help the layman understand the math and how it has been many years of Algo Duping to get us to where we are today and the more you understand, the more we can fight back against bad math and code that has been duping you and our government forever. Perhaps some day we will have some action that will allow some reverse engineering of some of the “magic math potions” that have allowed the re-distribution of money in the US and the world.

Listen to the Quants who speak out…the early ones who were there when this all began as they too had no clue as to how it would evolve as they thought they were there to increase efficiencies but as the power of math models evolved they soon found out that manipulation became the name of the game.

[…] we don’t check something, we get fooled and pay more. This is what I call the world of the Attack of the Killer Algorithms as it is math models and computer codes that run everything so be aware, be very aware as it’s a […]

[…] the smart I have an entire different view of “the real world” and kind of align myself with people like Emanuel Derman, a Quant who teaches a Columbia and was one of the first Quants who worked at Goldman Sachs years […]

[…] out I’m not the only one who writes about this topic. I’ve writing about what I call “The Attack of the Killer Algorithms” for a number of years. I saw it come to surface with the Occupy Movement as that was a cause […]

[…] just want fair drug prices and a stop to the “tricky front running killer algorithms” that soak us for more money when we fill our […]

write a paper for me http://dekrtyuijg.com/

Good info. Appreciate it.